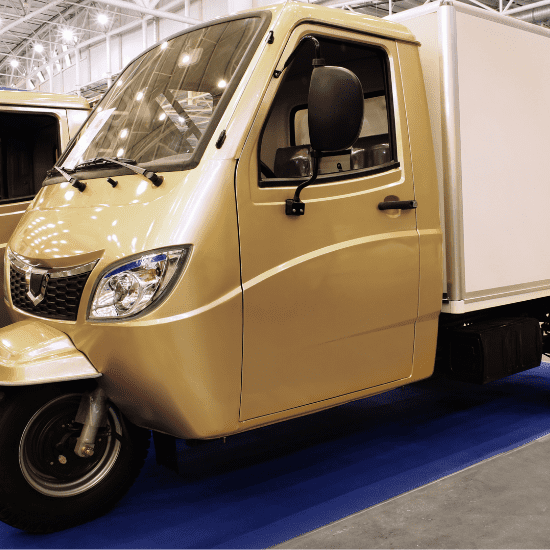

Buy Three Wheelers insurance in mumbai

Online three wheeler insurance in Mumbai

Get your three-wheeler insured now! Three-wheeler insurance in Mumbai is crucial as it would help you to protect your vehicle- be it personal loss, or any third-party losses. If you currently own a three-wheeler, the Indian Motor Vehicle Act mandates for you to have a Liability Only Insurance Policy. Three-wheeler insurance cover at Fund Pinnacle helps you protect your three-wheeler from damages at pocket-friendly premiums. We at Fund Pinnacle would provide financial coverage for repairs in case your vehicle meets with an accident. The insurance policy would also cover your loss or any third-party losses depending on the policy that you select.

Three Wheeler Insurance Agent in Thane

Want to ensure travel safety for your passengers and yourself? Owning a commercial vehicle comes with its own set of responsibilities for its owner. One of the responsibilities is getting your commercial vehicle insured. While the Liability Only Insurance Policy is mandatory, there are several insurance policies to choose from. Likewise, there are several three-wheeler insurance agents in Thane, but choosing the most appropriate one is important!

Applying for a three wheeler insurance amid the ongoing lockdown can be quite cumbersome and we at Fund Pinnacle help you resolve this. Our online insurance feature helps you get your three-wheeler insured from the comforts of your home.

Benefits of three-wheeler insurance

There are several advantages that you would avail for having three-wheeler insurance:

- Covers third-party penalty claims if the insured vehicle has been involved in an accident.

- Survivors of the accidents are often provided with extra benefits in case the accident caused any death.

- Provides lawsuit coverage, coverage of legal fees for charges brought against you.

- It provides car repair coverage due to damage in case of an accident.

Note: Coverages are based on your third-wheeler insurance policy.

Types of three-wheeler insurance policies

There is mainly two types of insurance policies that you can choose from for your three-wheeler:

Third-Party Insurance

According to the Motor Vehicles Act that was introduced in 1988, every vehicle owner including commercial vehicle owners is required to insure their vehicles with third-party insurance. Third-party insurance covers any financial liabilities that would arise from damages caused to a third party or property by the insured vehicle. This type of insurance policy however provides any benefit to the vehicle itself but only covers third-party liability.

Comprehensive Insurance

This type of commercial vehicle insurance is optional and not mandatory for a commercial vehicle owner. It is always advisable to purchase a comprehensive policy because it covers damages to the vehicle along with third-party liability. This insurance policy would help you to safeguard your vehicle against damages that arise out of man-made disasters or natural calamities.

Liability Only Policy - What does it cover?

Among all the three-wheeler insurance policies, Liability Only Policy is mandatory according to the Indian legal system and is a statutory requirement. Commercial vehicles are required to own a Liability Only policy as it covers any loss, injury, or damage costs from an accident where your vehicle has been involved. However, Liability Only policy provides the minimum coverage and does not cover costs that might arise from non-collision events. Liability Only policy is however more cost-effective as compared to other commercial vehicle policies as other policies provide comprehensive coverage. This leads to higher premium rates for other insurance policies. A liability-only policy is available for auto-rickshaws and goods-carrying vehicles. If you are a Liability Only Insurance policyholder at Fund Pinnacle, we would cover the financial costs arising from accidents of the insured vehicle. We provide online three-wheeler insurance in Mumbai to make your experience hassle-free.