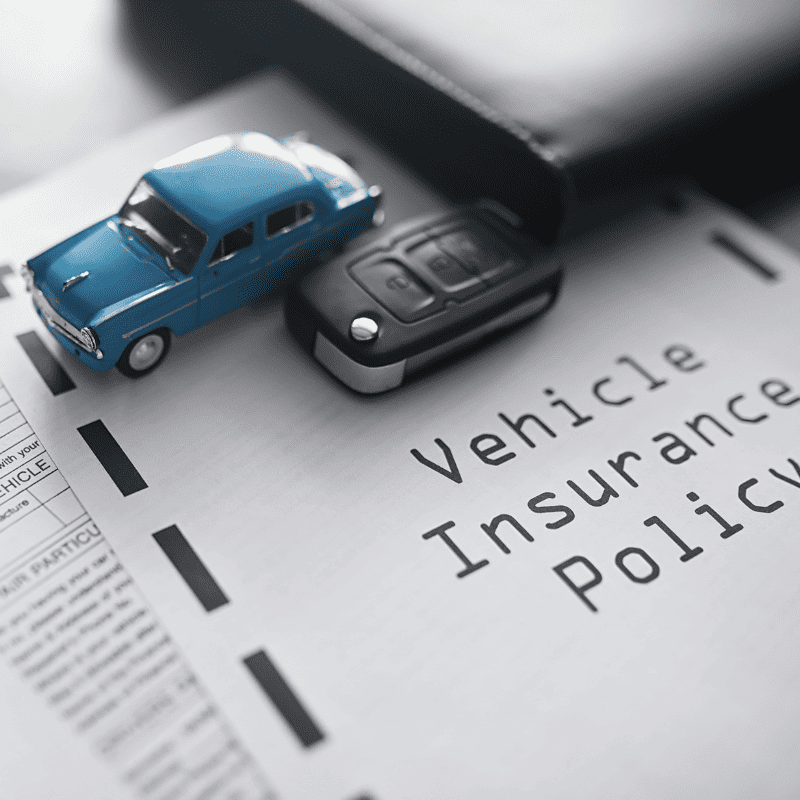

Car Insurance Agents in Mumbai

Importance of car insurance in Mumbai

Car insurance plays a vital role in Mumbai, offering numerous benefits and ensuring financial security for vehicle owners.With bustling streets and heavy traffic, accidents, and mishaps are common occurrences. Car insurance provides coverage for damages to your vehicle, theft, natural calamities, and third-party liabilities. In a city like Mumbai where the risk of accidents and theft is relatively high, having a car insurance policy in Mumbai is always essential. It not only protects your investment but also fulfills legal requirements. Additionally, car insurance provides peace of mind and helps mitigate financial burdens arising from unforeseen events. Whether it's car online policy purchases, competitive car insurance quotes, or convenient car insurance renewal options, car insurance in Mumbai offers comprehensive coverage and peace of mind for all vehicle owners.

Benefits of having car insurance

Having a car insurance policy comes with a multitude of benefits that provide financial security and peace of mind to car owners. Here are some key advantages of having a car insurance policy:

Financial Protection: A car insurance policy safeguards you against unexpected expenses arising from accidents, theft, or damages caused to your vehicle. It covers repair costs or even provides a replacement, saving you from significant financial burdens.

Liability Coverage: Car insurance includes liability coverage, which protects you from legal and financial liabilities in case your vehicle causes injury or property damage to a third party. It covers medical expenses, legal fees, and potential lawsuits.

Personal Accident Coverage: Many car insurance policies offer personal accident coverage, providing compensation for injuries or death resulting from accidents involving your car. It covers medical expenses and may also include disability benefits.

Peace of Mind: Knowing that you are protected by four-wheeler insurance brings peace of mind. You can drive confidently, knowing that any unforeseen damages or accidents will be taken care of financially.

Legal Compliance: Car insurance in Mumbai is often a legal requirement, including in India. Having a valid car insurance policy ensures compliance with the law and prevents legal consequences, fines, or penalties.

Additional Benefits: Car insurance policies may offer additional benefits such as roadside assistance, coverage for vehicle accessories, and options for no-claim bonuses, which reward safe driving habits and lower premium costs.

Add-Ons and Riders: Enhancing Your Car Insurance Coverage

Add-ons and riders offer additional coverage options that can be added to your car insurance policy to enhance the level of protection. These features provide specific coverage for various scenarios and tailor your policy to better suit your needs. Let's explore some common add-ons and riders discussed on car insurance websites:

1. Zero Depreciation Cover:

Zero depreciation cover, also known as nil depreciation or bumper-to-bumper cover, ensures that you receive the full claim amount without considering the depreciation of car parts during repairs or replacements. This add-on is particularly beneficial for new or luxury vehicles.

3. Engine Protector:

Engine protector coverage safeguards your car's engine against damages caused by water ingress, oil leakage, or hydrostatic lock. This add-on covers the repair or replacement costs of engine components, which can be financially burdensome.

4. Personal Accident Cover:

Personal accident cover provides additional financial protection in the event of accidental death or disability of the policyholder. It offers compensation for medical expenses, loss of income, and other related costs resulting from an accident.

5. No Claim Bonus (NCB) Protection:

No claim bonus protection allows you to safeguard your accumulated NCB even if you make a claim during the policy period. It ensures that you retain the NCB discount on your premium at the time of policy renewal, rewarding you for claim-free years.

how to file a car insurance claim?

Contact your insurance provider and notify them about the incident.

Provide necessary information such as policy number, date, and description of the incident.

File a First Information Report (FIR) at the police station, if required.Contact your insurance provider and notify them about the incident.

Document the incident by taking photographs and collecting relevant bills and receipts

Complete the claim form provided by your insurance company.

Submit the claim form along with supporting documents.

Cooperate and respond promptly to any queries from the insurance company.

Allow assessment and inspection of damages, if required.

Follow the instructions of the insurance company for claim settlement.

Documents Required to File Car Insurance Claim

When filing a car insurance claim, the following documents are commonly required:

Claim Form

Copy of Insurance Policy

Driving License

Registration Certificate (RC) of the Vehicle

Police Report (FIR)

Accident Description

Photographs:

Repair Estimates:

Bills and Invoices:

Third-Party Details:

Medical Reports and Bills:

Bank Account Details

ID Proof like aadhar car or pancard

Legal Requirements for Car Insurance in Mumbai:

It is mandatory for vehicle owners to comply with certain legal requirements regarding car insurance in Mumbai. The Motor Vehicles Act stipulates that all vehicles must have at least a third-party liability insurance policy. This coverage protects against any bodily injury or property damage caused to a third party by the insured vehicle. It is crucial to ensure the car insurance policy remains valid and is renewed on time to avoid penalties and legal consequences. Vehicle owners should carry the necessary documentation, including a valid insurance certificate while driving in Mumbai. Adhering to these legal requirements ensures financial protection and compliance with the law.

Car insurance agents in Thane

There are several car insurance plans in Mumbai that you can avail of. Your car can be insured for several incidents such as fire, accidents, theft, bodily injuries, and many more. Your car insurance would also help you to recover any form of physical damages that arise from non-collision events. Suppose you are caught in the middle of a storm and a heavy object hit your car's hood. These types of events are considered to be non-collision events and could be insured using car insurance. There are several car insurance agents in Thane. However, choosing the right insurance agent is also equally important! Here at Fund Pinnacle, we assist you to choose the right policy that would be ideal for your car and your needs. We would help you to choose the car insurance policy that would be suitable for your risk profile. We would firstly educate you about the car insurance policies that are available in the market and brief you about the same so that you can make an informed decision. We aim to provide our customers with a smooth and easy-going experience. We provide rapid settlement of claims, quick renewals, and affordable premiums to our customers. We also provide additional covers at minimum premium rates that would help you to save your money on car repairs.

A car insurance policy provides coverage for various risks and damages. The specific coverage may vary depending on the type of policy and insurer, but here are some common aspects covered:

- Own Vehicle Damage: Coverage for damages to your own vehicle due to accidents, collisions, fire, or theft.

- Third-Party Liability: Protection against bodily injury or property damage caused to a third party by your vehicle.

- Personal Accident Cover: Compensation for injuries or death of the policyholder or passengers in the insured vehicle.

- Natural Calamities: Coverage for damages caused by natural disasters such as floods, earthquakes, storms, or cyclones.

- Theft and Vandalism: Protection against theft of the insured vehicle or damages caused by vandalism.

While car insurance provides crucial protection, there are certain exclusions and situations not covered by a standard policy. These may include:

- General Wear and Tear: Regular wear and tear of the vehicle, including mechanical breakdowns or maintenance-related issues.

- Driving Under the Influence: Damages or accidents caused while driving under the influence of alcohol or drugs.

- Illegal Activities: Damages caused while using the vehicle for illegal purposes or engaging in criminal activities.

- Unlicensed Drivers: Damages caused by an unlicensed or underage driver operating the insured vehicle.

- Racing or Speeding: Damages resulting from participating in racing events or driving at excessive speeds.

Benefits of cashless claim settlement and convenient repairs:

By opting for cashless claim settlement, you can experience a seamless and hassle-free process. When you take your car to one of our network garages for repairs, you don't have to worry about arranging funds for the repairs upfront. Our insurance company settles the repair bills directly with the garage, saving you from the financial burden.

Moreover, our network garages are equipped with skilled technicians and use genuine spare parts, ensuring high-quality repairs for your vehicle. You can have peace of mind knowing that your car will receive reliable and efficient repairs within a reasonable timeframe.

With cashless claim settlement and convenient repairs, we aim to provide a smooth and satisfactory experience for our customers in Mumbai, ensuring that your car gets back on the road as quickly as possible.

Benefits of Buying Car Insurance Online

Convenience:

Purchasing car insurance online is convenient as it allows you to compare policies, get quotes, and complete the purchase process from the comfort of your home or office.

Time-saving:

Online platforms provide a quick and streamlined process, eliminating the need for paperwork and lengthy documentation. You can get insured within minutes, saving you valuable time.

Cost-effective:

Online car insurance policies often come with competitive premium rates and discounts, enabling you to find cost-effective coverage options that fit your budget.

Easy comparison:

Online platforms allow you to compare multiple insurance providers, their coverage options, and premium rates side by side, enabling you to make an informed decision.

Instant documentation:

You receive policy documents instantly via email, providing immediate proof of coverage.

Hassle-free claims:

Many insurers offer a seamless online claims process, simplifying the claim settlement and making it convenient for policyholders.