Debt Mutual Fund Schemes in India

Debt Mutual Fund Schemes in India for Investment?

Let Fund Pinnacle help you make safe and smart investments in Debt Funds

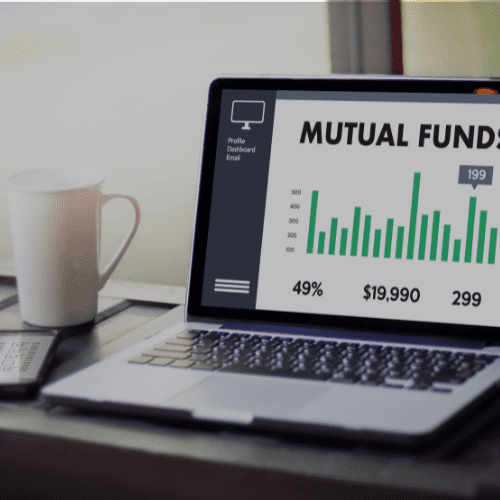

Mutual Funds are the go-to investment option for a lot of people who prioritize the safety of investments over returns. One of the Mutual Funds, which provides a steady interest rate until the maturity of the period is a Debt Mutual Fund. They are also called bonds. These are generally issued by governments and corporations to collect funds for specific reasons and pay a higher interest rate than savings accounts.Since these are issued by reliable entities, there seems to be little risk in investing in Debt Funds or Bonds. But that’s not always the case!

Debt Mutual Funds India

Mutual Funds are one of the more recent and the most progressive investment tools. They are classified further into various types depending on the nature of the investment. One such type is Debt Mutual Funds. For a detailed understanding of the topic, you should consult a financial service provider who offers mutual fund investment distribution in Mumbai.

Take the help of a Mutual Fund advisor

For an investor, it may be difficult to know which debt fund is good to invest in. Here comes into the picture professional mutual advisors and rating agencies. Your mutual fund advisor can give you background and contextual information about debt funds to help you choose the one that best suits your financial goals. Rating agencies provide appropriate ratings based on a number of parameters. These ratings can help you identify the best bonds for your investment.

What are Debt Mutual Funds?

Debt mutual funds are basically a bond. A bond is nothing but a loan. So who needs a loan? Several institutions borrow money to support their financing needs. These institutions include the central government, state government, banks, NBFCs, infrastructure finance companies, home loan providers, and, of course, corporations.

The institution issuing the bond or debenture becomes the bond issuer and sets the following terms:

- Principal amount

- Term of maturity

- coupon or interest rate

Those who invest in bonds become the bondholders. A bond is basically a promise to pay a definite amount at the end of the maturity period. This promise is not void of risks as with any type of investment.

Credit risk of Debt Mutual funds

The quantum of risk involved in any debt mutual funds varies from company to company. Some companies enjoy a high reputation in the market due to their huge revenue and strong profits and thus can service their debt obligations easily. These companies are given the highest rating by credit rating agencies like crisil, care, and icra and are displayed as AAA or A1+.

On the opposite end of the spectrum are companies that have shaky financials and consequently, their bonds or debt mutual funds carry a higher level of credit risk. These bonds are represented by descending alphabets and numeric signs like BB or B- or even D. As a lay investor, you may find such technicalities difficult to comprehend.

Types of Debt Mutual Funds

In 2018, SEBI categorised debt mutual funds into 16 categories:

Overnight Fund

Liquid Fund

Ultra Short Fund

Low Duration Fund

Money Market Fund

Short Duration Fund

Medium Duration Fund

Medium to Long Duration Fund

Long Duration Fund

Dynamic Bond Fund

Corporate Bond Fund

Credit Risk Fund

Banking & PSU Fund

Gilt Fund

Gilt with 10Y Constant Duration Fund

Floater Fund

Who Should Invest in Debt Mutual Funds?

The objective of investing in debt funds is very different from investing in shares. for wealth appreciation, the primary objective of debt is and should always be the protection of capital.

Investors looking for long term investing will be better served with a series of bonds of shorter periods ranging from 3 to 4 years rather than a huge chunk of a single bond with 10 to 15 years of maturity period. This approach of breaking your bonds investments into smaller chunks offers two big advantages:

- Gives greater protection of capital by regulating the risk involved

- Allows you to take better advantage of capital appreciation opportunities

Taxation on Debt Mutual Funds

Short-term gains: The tax on Debt Fund held for less than 3 years is calculated according to the income tax bracket for that individual.

Long-term gains: Interest earned on debt funds that are held for over 3 years is counted under Long-Term Capital Gain. The applicable tax rate here is 20% with indexation and 3% cess which work out to 20.90%.

Why Choose Fund Pinnacle?

By now you must have understood that there’s more to Debt Mutual Funds investing than a casual glance at the performance, expense ratio, and other peripheral factors.

Fund Pinnacle with its team of expert advisors is the go-to Mutual Fund investment distribution in Mumbai.

Fund pinnacle understands that debt funds can’t be treated as a buy-it and forget-it instrument. There are many factors at play and it becomes all the more important to go deeper and understand specific debt-related terminologies that only reputed organisations as Fund Pinnacle can do.

In Conclusion

Debt Funds or Bonds are one-time investments in an investment plan where the investor receives interest rates that are higher than savings bank or even fixed deposit schemes. However, to choose the best debt funds for your investments, you should take the help of a financial services company that provides Mutual Fund investment distribution in Mumbai. For information and investment advice, you can contact Fund pinnacle, which is a leading mutual fund distributor in Mumbai and Thane.